Wesley Financial Group Review

Table of Contents

1. Wesley Financial Group Cancellation Process

2. Wesley Financial Group vs Do It Yourself

3. What Qualifies Someone to Work

With Wesley Financial Group

5. Wesley Financial Group is Financially Strong

6. Wesley Financial Group’s Other Businesses

Pros:

- 100% Money-Back Guarantee

- High Dunn & Bradstreet Rating

- Excellent Customer Service

- 300+ Employees

- A+ BBB Rating

- In Business Since 2012

Cons:

- No Escrow Payment Option

- Does Not Work With Inherited Timeshares

- No Spanish Speaking Agents

Wesley Financial Group is one of the oldest and largest timeshare exit companies in the industry. They have been in operation since 2011, and their offices are located in Las Vegas, NV, and Franklin, TN.

Wesley Financial Group can speak to having helped over 15,000 timeshare owners resolve problems with resorts and developers. With over 450 employees on board, Wesley is a company that has not only scaled up and grown significantly over time, but has also prioritized customer service and provided individualized assistance for each of their clients.

Wesley Financial Group Cancellation Process

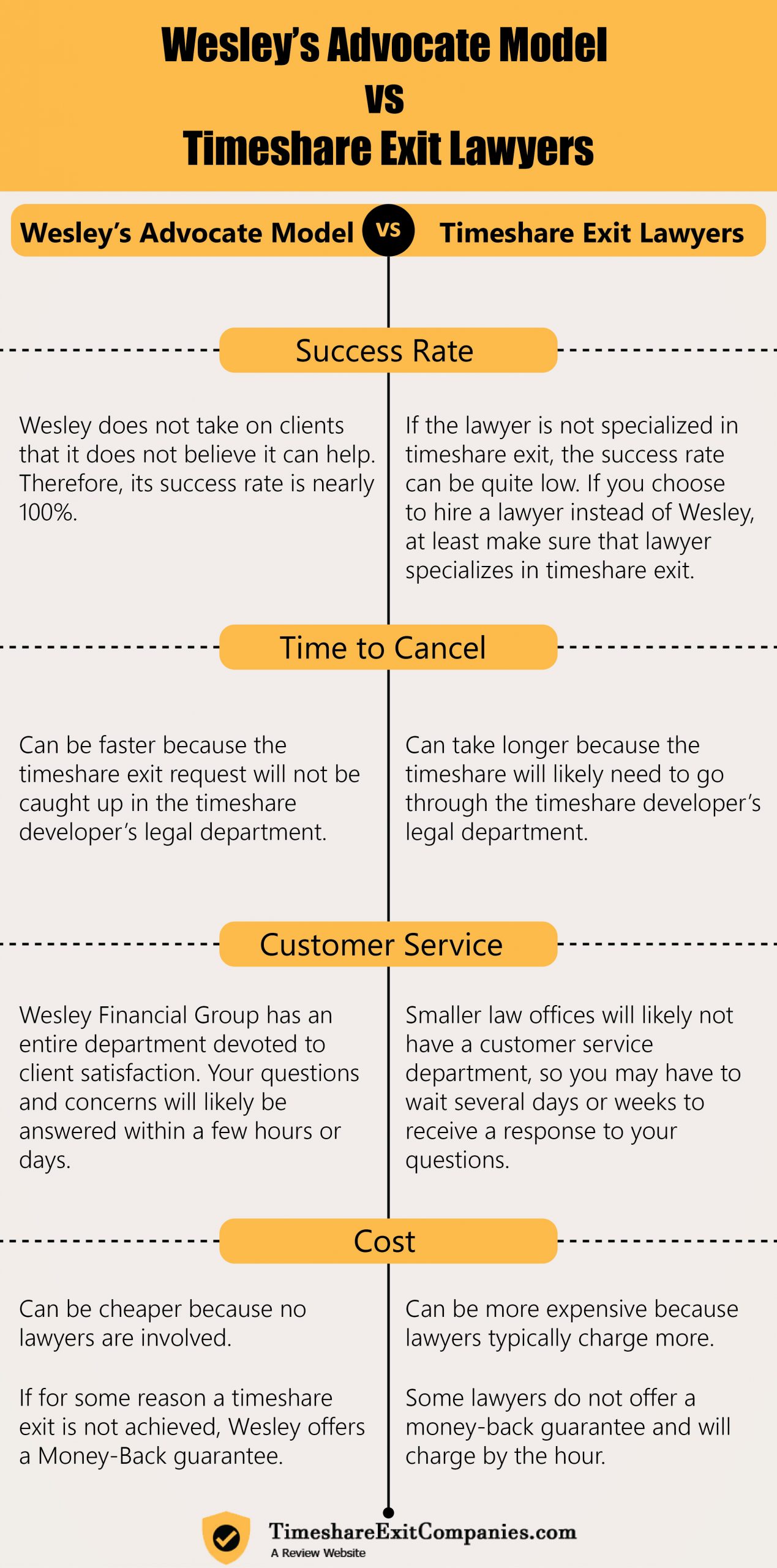

Wesley Financial Group’s timeshare exit process is different from other timeshare exit companies’, in that they use something they call the “Advocate Model.” This is unique to Wesley, and varies a great deal from processes that simply use lawyers to advocate on your behalf. Wesley instead assists their clients to write letters and make phone calls to their timeshare companies, which is not only helpful, but also empowering.

It’s not just empowering: this model has several other qualities that put it above the typical lawyer-led model. To begin with, it curtails the bureaucracy that is inevitable when dealing with a timeshare company’s legal department. By this we mean that, once you start using a lawyer to manage your communication with a timeshare company, the company will begin to handle your case through their legal department.

From that point forward, it’s highly likely that your timeshare account will be placed on lockdown, which will make it almost impossible for your issue to be resolved, no matter who takes it on. Meanwhile, you’ll simply get told by the timeshare company’s legal team that you’ve been frozen because of the so-called “binding” contract you signed, and thereby ignore all your attempts at making contact. Basically, according to Wesley, it’s too overt for such dishonest businesses to deal with, and could even hurt you in the long run.

Since Wesley does not manage timeshare cancellation using legal letters like this, timeshare companies do not operate in kind and assume that you have hired a lawyer to get you out of your timeshare. Ultimately, Wesley reports that this has a great rate of success.

The team at TimeshareExitCompanies.com definitely believe that this is a highly effective model to follow. That said, we’d add that there are times when working with a lawyer can be to your benefit – and, in some situations, absolutely vital to exiting a timeshare. There are some timeshare companies and resorts that won’t even listen to you or respond to you unless you have a lawyer backing your actions and complaints. In those situations, having a solid legal team who knows how to put pressure on the company is a major boon. If suing the developer is on the table for any reason, that’s also a case in which having a lawyer’s expertise can be necessary.

You should keep in mind, regardless of your situation, that not only does Wesley have a track record of only taking on clients they truly believe they can release from their timeshare contracts, they also offer a 100% money-back guarantee. So if you were to work with them and their method was not successful, you would be entirely protected by this promise.

Wesley Financial Group vs Do It Yourself

Wesly Because Wesley’s model is so unique, it’s important to be sure you fully understand how using it could benefit you, and especially to know if those pros would outweigh those of pursuing a timeshare cancellation on your own.

Of course, you might still be wondering how trying to get out of a timeshare on your own would even work. Or it could be that you’ve heard about how several timeshare resort developers have created programs, typically called “deed back” or “take back” programs, that are supposed to help you easily exit a timeshare on your own terms.

As of Feb. 2022, according to Responsible Exit– a website made in collaboration with ARDA and the Coalition for Responsible Exit – the following developers offer what’s referred to as a “deed back” or “buy back” program:

- Bluegreen Vacations®

- Club Wyndham®

- Diamond Resorts®

- Hilton Grand Vacations®

- Holiday Inn Club Vacations®

- Marriott Vacation Club®

- Westin Vacation Club®

- Hyatt Residence Club®

- Margaritta Vacation Club by Wyndham®

- Shell Vacation Club®

- Sheraton Vacation Club®

- Vistana Signature Experiences®

- Westgate Resorts®

- Worldmark by Wyndham®

- Wyndham Destinations®

- Welk Resorts®

- Capital Vacations®

While ARDA claims that you should be able to easily get in touch with any of these developers and get out of your timeshare without any outside help, this is unfortunately not usually the case. We have received several reports from people who have unsuccessfully spent their time and energy to try and use this kind of program, only to be hit with the typical response: that, because they signed a contract, the company cannot do anything for them.

This can be an even worse situation if you still owe any money to the resort, be it a mortgage or outstanding maintenance fees. It’s far less likely for the timeshare company or resort to take any interest in your situation if that’s the case. Of course, even if you are up-to-date on either of these, it is still very common for timeshare companies to refuse to take back timeshares, regardless of any ARDA claims. This is why it can get so complicated to try and get out of a timeshare on your own, and without the help of an exit company like Wesley Financial Group.

So what are your options if you’re faced with a company’s refusal to take back your timeshare? You can try and get out of your timeshare on your own – or, you can work with Wesley Financial Group, and have them guide you through the exit process as well as get their help to protect your credit.

Choosing to try and get out of your timeshare independently is riskier: there’s more of a chance that your credit could be damaged by the time you complete the process. There’s also a chance – albeit a rare one – that the resort or timeshare developer could try to sue you. Wesley Financial Group is an excellent option when your cancellation requests have been ignored time and time again, and you’re ready to enlist the help of a company with a history of resolving thousands of timeshare issues.

What Qualifies Someone to Work With Wesley Financial Group?

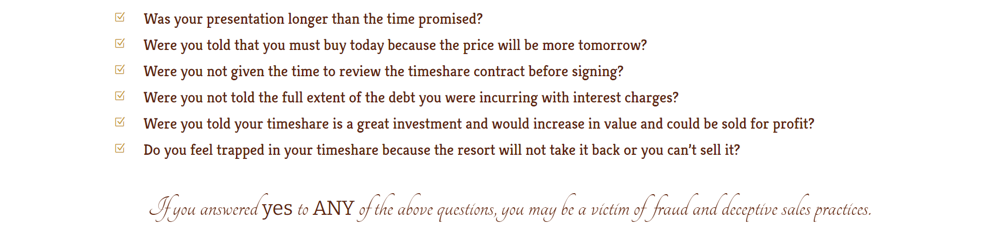

One quality that makes Wesley Financial Group so outstanding is their selectivity when it comes to choosing clients. While most timeshare companies tend to be indiscriminate to a fault, Wesley only works with timeshare owners that feel strongly that they were deceived or lied to during the resort’s sales process. They are also highly selective when it comes to which resorts and timeshare developers they get involved with. While they will pursue cases with over 300 different global developers, there are several travel clubs that they cannot work with.

So if you are interested in working with Wesley, you should be sure to keep these parameters in mind. They do imply that if you bought your timeshare on the resale market or were given it by someone else, you are not eligible to work with them. But if you think you were unfairly treated or swindled in buying your timeshare, and did so from one of the many resorts they work with, you would definitely qualify.

We give Wesley bonus points for being so selective when it comes to the timeshare owners and developers they work with.

There are so many timeshare exit companies who are so profit-hungry that they take on every client, no matter what, regardless of whether or not they can actually serve them well. Wesley Financial Group is different: they only invest in working with timeshare owners they know they can successfully help. This is likely the reason why they’ve stayed in business so long and can speak so few negative online reviews (and, we should add, so many positive testimonials).

Quick note to readers: Travel clubs are not the same as vacation clubs. The term “vacation club” is typically used by timeshare developers who simply wanted to use a different word than “timeshare” for the same product to avoid being affiliated with scams. A few examples of vacation clubs are Disney Vacation Club and Marriott Vacation Club. A “travel club,” on the other hand, is something for which you’d pay for a membership, and receive different “travel discounts” in exchange. The Travel Advantage Network and Pacific Palm Destinations are two examples of travel clubs.

A Track Record of Success

Unlike many other timeshare exit operations, Wesley has regularly demonstrated both successful cancellations and consistent annual growth as a company. There’s plenty of evidence online that speaks to this track record. An early 2020 press release, for example, highlights that Wesley “successfully cancelled 3,390 timeshares in 2019, resulting in nearly $50 million in mortgage debt relief for its clients.” That same article cites 1,114 timeshare cancellations in 2018, as well as nearly $15 million in debt relief, and says that Wesley’s average time for a timeshare exit to resolve is less than 300 days overall.

A newer press release from January 2021 adds to this, sharing that Wesley had year-over-year increases of 195% in timeshare cancellations, as well as increases of 234% in debt relief. It also states that Fortune magazine not only named Wesley one of its Best Workplaces for Women™ in 2020, but also ranked them at No. 203 in their 500 Fastest Growing Private Companies.

All of this is nothing short of impressive, and it’s an excellent marker of how effective and reliable Wesley’s timeshare exit process can truly be.

Wesley Financial Group Is Financially Strong

One quality of Wesley Financial Group’s that you can definitely trust is its financial strength and viability. Their 100% money-back guarantee speaks to this; in order to honor it, which they do, they need to always have money in the bank. There have been several other companies that pay lip service to the same kind of guarantee, but cannot fulfill those promises due to having insufficient funds in the bank – Resort Release is just one such company. In fact, this company was shut down by the authorities because of their failure to come through on their guarantee. You can be sure that you won’t run into this same situation with Wesley.

Wesley Financial Group has also been given a high rating with Dun & Bradstreet, demonstrating its financial strength and high net worth. The latter is especially important because it establishes the reliability of Wesley’s 100% money-back guarantee in the situation that your timeshare case does not get resolved. That said, keep in mind that it’s not likely a client would ever need to use this guarantee, because Wesley does not take on cases their team does not think they can complete successfully.

Wesley Financial Group’s Other Businesses

Wesley Financial Group has applied their financial expertise to a few other business ventures in recent years. This has allowed them to diversify the services they offer while continuing to build a strong reputation in consumer advocacy and wealth management. Here is some additional information on Wesley’s other businesses.

- Wesley Mortgage is a mortgage and refinancing company that was launched in 2021. They are focused on making home ownership accessible through their services.

- Wesley Financial Management is an investment company that has been in business since 2009. They are focused on meeting consumers’ individual financial needs through specific investment strategies, and helping them with their credit and wealth management.

- Wesley Insurance is a firm that offers whole life (also known as final expense) insurance. They have been doing so since 2020, and are committed to educating people on the different kinds of whole life insurance policies that are available, while also connecting them with the policies that best suit them and their families.

Wesley Financial Group Reviews

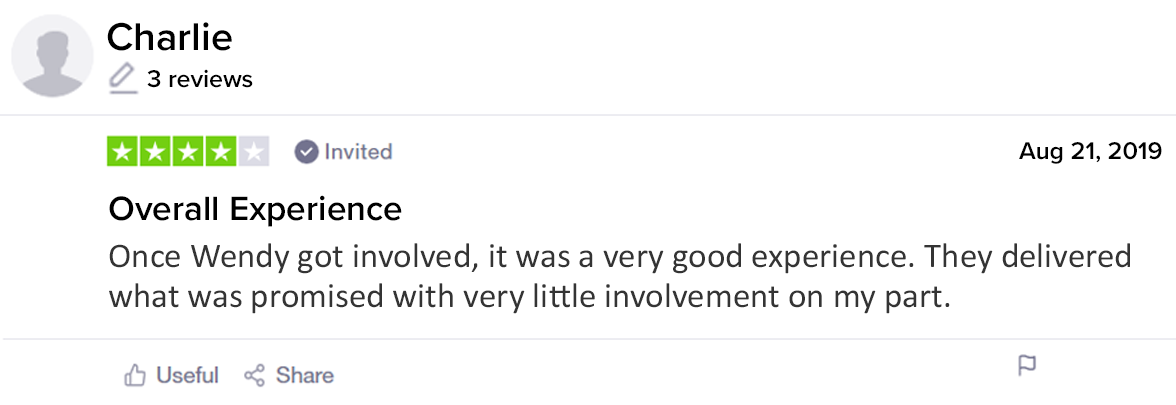

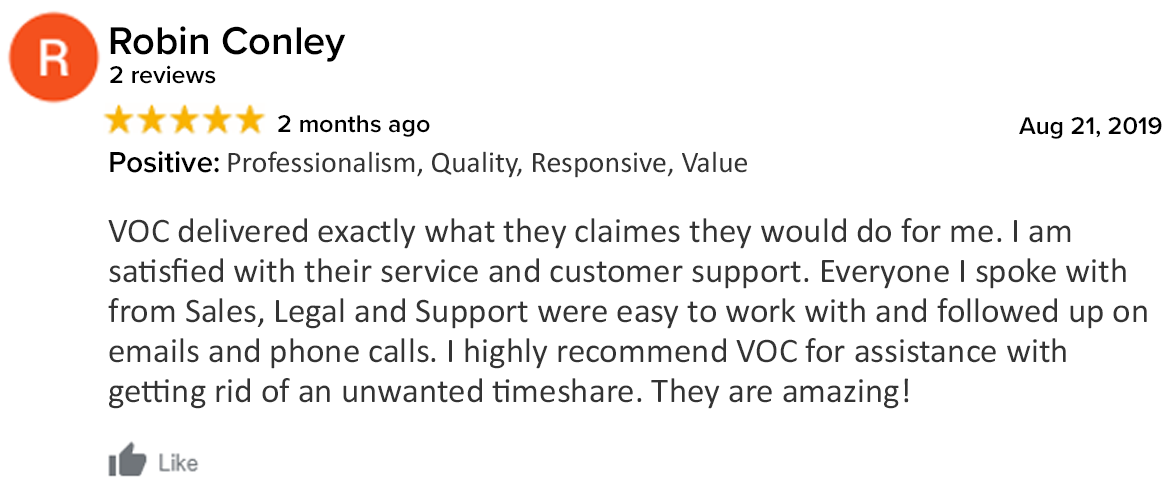

Wesley Financial Group has hundreds of positive and five-star reviews across the board, including with Google, Trustpilot, and Best Company. That these ratings are consistently so high on various websites says a great deal about how trustworthy and legitimate they are.

Wesley can also speak to having an A+ with the BBB. Readers will note that they are not currently accredited; this is because their accreditation was suspended in 2019, and is in the process of being restored. Though this isn’t ideal, and something to be aware of, it is a good sign that they have maintained their high rating in the face of this. They also only have about 50 complaints from the past three years, nearly half of which have already been addressed and resolved.

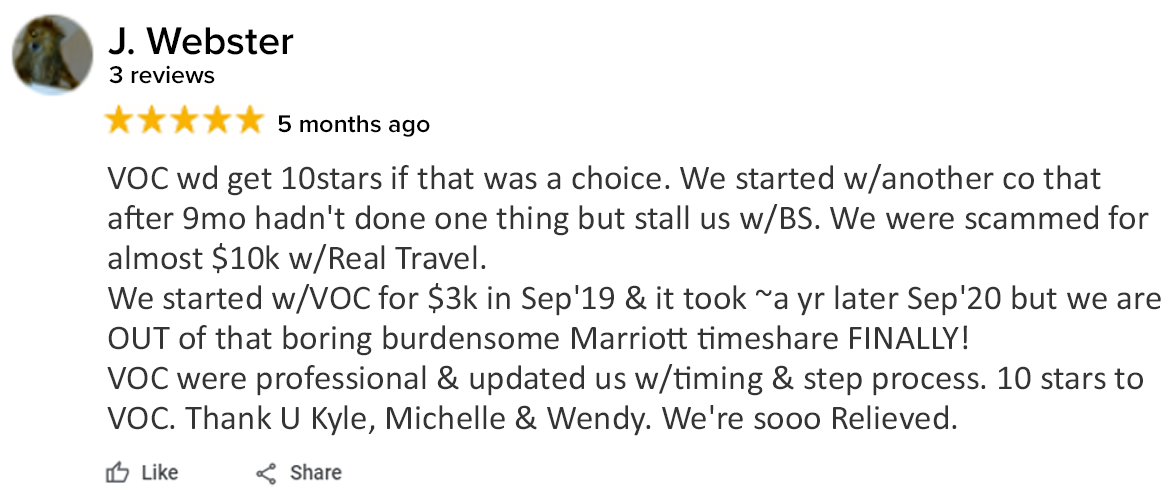

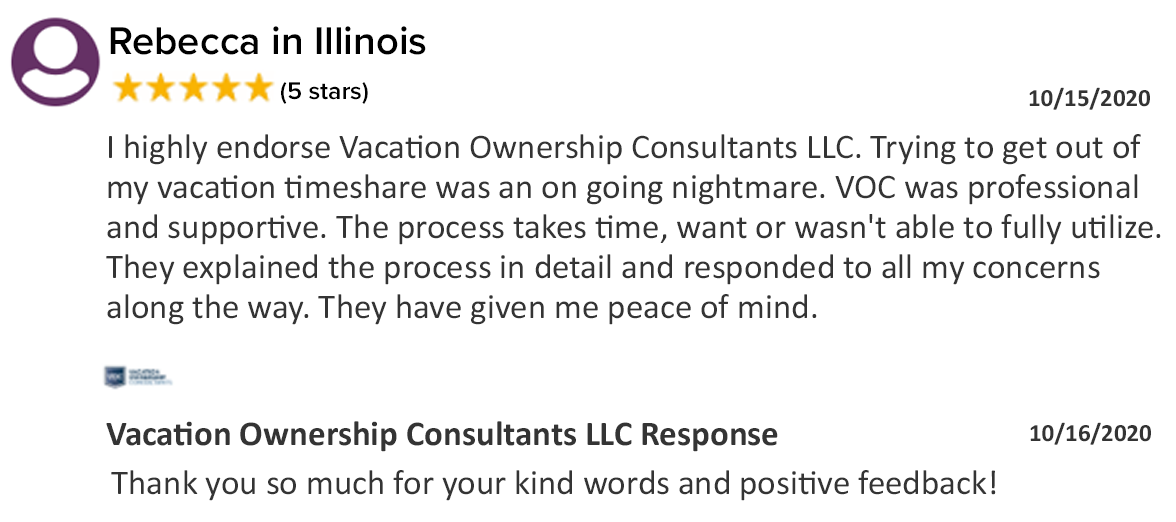

All of this suggests that they are adhering to their high standards even while facing challenges. Let’s have a closer look at a few examples of reviews of Wesley Financial Group.

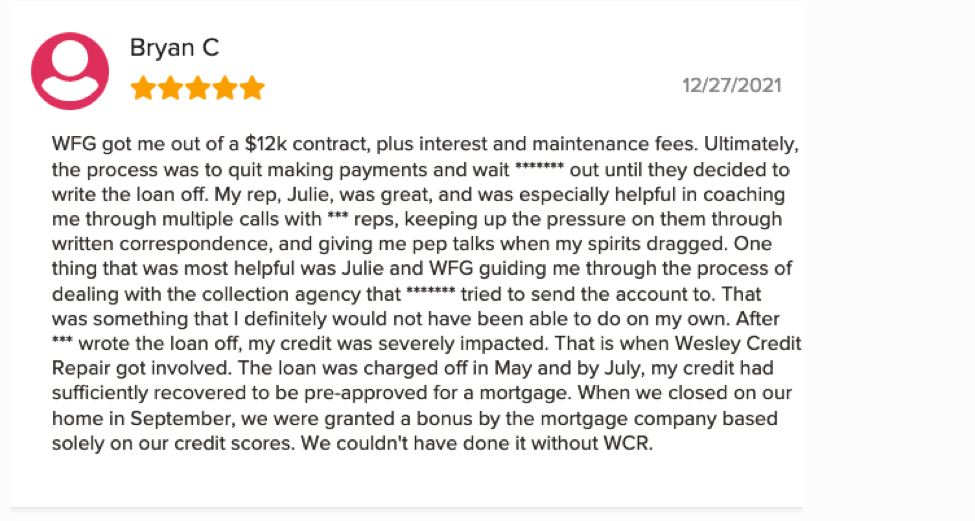

This BBB review is a great example of how thorough Wesley Financial Group’s timeshare cancellation is in general. Not only did they release this timeshare owner, Bryan, from his contract, but they also did the work of walking him through the details of the process. That they followed up to help repair this timeshare owner’s credit speaks volumes, because timeshare owners’ credit is often damaged after the exit process.

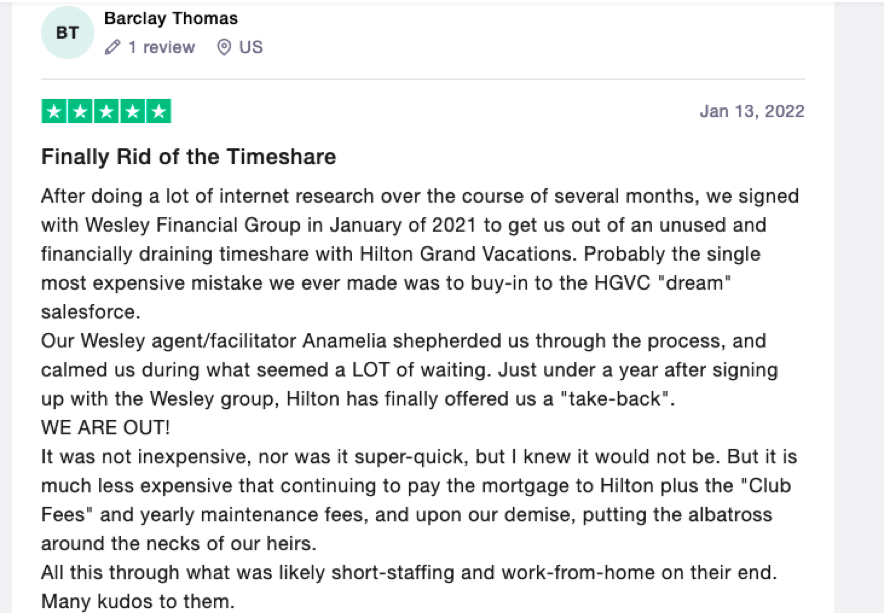

Here is another great example of a review from Barclay Thomas, via TrustPilot:

Not only is it incredibly difficult to get out of a Hilton Grand Vacations timeshare – it’s even more challenging to pressure them enough that they actually take a timeshare back. The fact that Wesley undertook steps to make this happen, and did so over nearly a year, says a lot about their work ethic and willingness to help their clients.

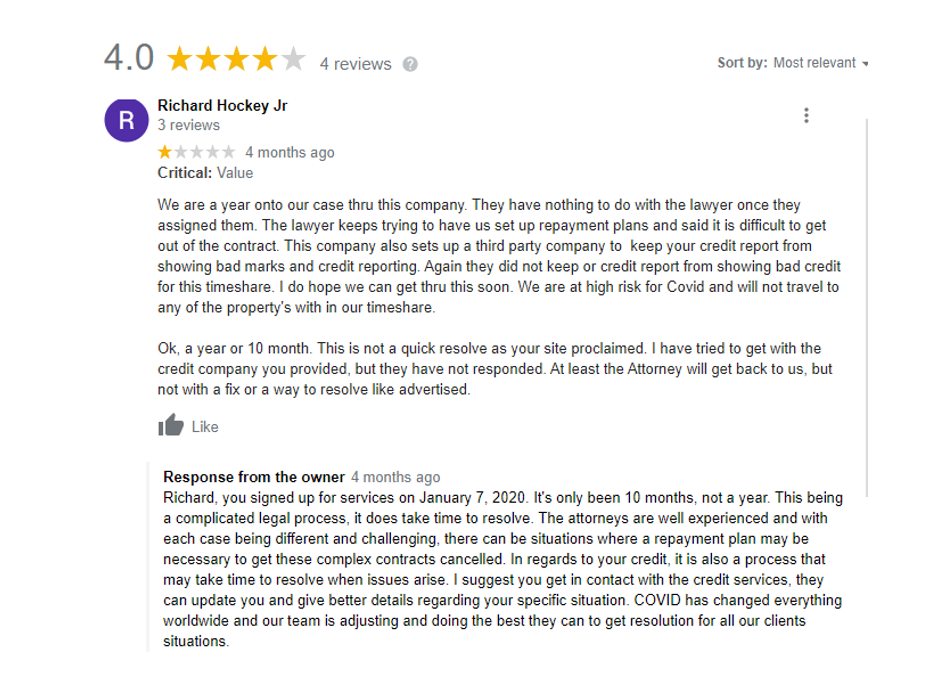

In light of these more positive reviews, we did want to make a brief note to address the handful of recent BBB complaints for Wesley. These are all very similar, mostly regarding lapsed communication, and nearly all of them have been resolved. Given Wesley Financial Growth’s recent growth, leadership changes, and having to deal with so many frivolous lawsuits (which you’ll see details about below – keep reading to learn more), we can see how this would transpire. Frankly, while it appears that, for the most part, both the complaints and the resolutions are legitimate, it is important to keep in mind that lawsuits like those Wesley has been facing can harm a business, even in the short term.

To us, these comments do not undermine Wesley Financial Group’s integrity as a company. They are, though, a reason to be absolutely sure that your case is one you want to take to them, since they are as selective as they are for good reason.

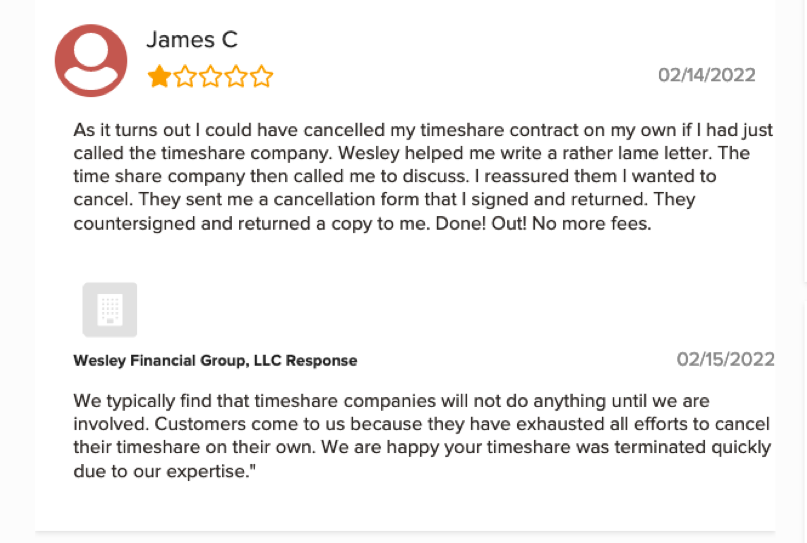

The exception to this we’re inclined to make is in light of the possibility that people have been asked to post negative reviews in order to make things more difficult in the midst of the resorts’ lawsuits against Wesley. This is one such review that gave us pause:

Few people who truly have struggled with timeshare contracts are this dismissive of having been helped, so it is hard to believe that this isn’t written with poor intentions. Fortunately, Wesley’s response is very professional.

Wesley Financial Group can also speak to having several video testimonials from past clients. This is a huge stamp of approval, as the willingness to be recorded says a great deal about how satisfied someone is with a company’s work. You’re getting someone’s full story, and it’s not just from their name in an online posting – they’re presenting themselves in every way. This is a great indication that Wesley Financial Group is a trustworthy timeshare exit company.

Here are a few examples of those videos:

Wesley Financial Group Cost

As with most timeshare exit companies, you can get a good feel for the cost of working with Wesley Financial Group through online reviews. Based on what we found through Wesley’s online reviews, you could expect to pay anywhere from $4,000 to upwards of $7,000, depending on your specific situation. Generally speaking, the cost of getting out of your timeshare will be much higher if you still owe a mortgage on the property. This is not unique to Wesley and would be the case with most other timeshare exit companies you might look into.

It’s also the case with most all timeshare exit companies that costs are not disclosed online, and Wesley is no exception. This is a general rule because of how personalized a service timeshare cancellation is. There are so many custom factors that play into getting out of a timeshare, including but definitely not limited to the complexity of your situation and your mortgage status. To get an accurate quote, the best step you can take is to contact Wesley Financial Group – that way, you can rest assured all of the details of your situation are being taken into account.

Who Is Chuck McDowell?

Chuck McDowell is the CEO of Wesley Financial Group. He founded the company back in 2011 as a result of his own experiences in the timeshare industry, working in sales for Wyndham Vacation Resorts. After becoming disillusioned with the typical timeshare sales practices, he resigned in order to start giving advice to his former customers that would help them exit their timeshares. This is the origin of Wesley Financial Group’s focus on clients who felt they were misled while buying a timeshare.

There are some comments online that McDowell has owned or been part of the leadership of a few other businesses in the past, but we were not able to officially corroborate these reports. Ultimately, his main work has been with Wesley Financial Group, as well as the new businesses opened under the Wesley name.

McDowell grew up in Tennessee, and attended Middle Tennessee State University. He started Wesley Financial Group with his two sons; he and his wife, Jo Ellen, reside in Franklin, TN.

Wyndham Vacation Resorts v. Wesley Financial Group

McDowell is known not just for starting an experience-driven timeshare exit company, but also for winning a lawsuit against his former employer, Wyndham – one of the biggest timeshare resort developers in the world. In 2013, Wyndham brought this lawsuit against Wesley Financial Group to accuse McDowell of divulging their trade secrets in his work helping timeshare owners get out of their contracts.

Fortunately, the jury was quick to decide that this was not in fact the case, taking only 12 minutes to make their decision. This win was huge for timeshare owners everywhere who run into trouble getting out of their contracts, as well as for McDowell, especially after such a major risk as taking on Wyndham in court.

Other Wesley Financial Group Lawsuits

As you can imagine, a company like Wesley Financial Group attracts similar lawsuits to Wyndham’s because of its size, reputation, and effectiveness. A few of the more recent lawsuits that have been brought are as follows:

-

- Diamond Resorts (2020). This lawsuit is based on several claims from Diamond, including that Wesley has timeshare owners breach their agreements by stopping payments, and falsely warns customers that continuing their timeshare payments will make the cancellation process take longer. Diamond used a number of personal attacks against McDowell to make their case. Wesley Financial Group’s public response to the lawsuit included ownership of past financial issues that McDowell has had, while reasserting that their activities are completely legal.

- Westgate Resorts (2021). Among Westgate’s many allegations are that Wesley engages in aggressive advertising and marketing, makes false promises about their timeshare cancellation process, and encourages Westgate timeshare owners to breach their contracts. Not surprisingly, these claims are very similar to those that Diamond Resorts made in their lawsuit.

As of Feb. 2022, these lawsuits are still in process, but it bears noting that both companies have run into legal troubles of their own – including class action lawsuits about their marketing and sales tactics. Not only that, but Diamond is actually suing five other companies in an apparent trend meant to overburden their competition. It’s a fair conclusion that these cases illustrate the lengths resorts will go in order to keep doing business in the dishonest ways that they typically do.

Wesley Financial Group In the News

The recent news and updates about Wesley Financial Group have been highly positive. In particular, 2021 was a strong year for them, beyond the above-noted massive increase in timeshare cancellations. They also reported having broken several internal records for both “inbound inquiries and new clients.”

Wesley also added to their leadership team in July 2021, reporting that Jinanne West and Stephanie Maxwell joined the company as president and general counsel, respectively. This was cited as being related to Wesley’s new mortgage company opening, as well as their seeking new opportunities to grow.

In August 2021, they were reported as having made the Inc. 5000 list for the second consecutive year, ranking as number 447 this time. According to their press release, this is based on revenue growth from 2017 to 2020, a span during which Wesley’s revenue increased by 1,091% – from $7.5 million to $84.4 million.

Overall, Wesley’s recent news shows their consistency and persistence when it comes to being a leader in the timeshare exit industry.

Wesley Financial Group’s Social Media

Wesley Financial Group has very active and professional-looking social media, which includes their Twitter, Facebook, and Instagram accounts. They post regularly, and they consistently use well-designed graphics, clear and coherent content, and solid information in their posts. It’s always a good sign when you can rely on the information that a company shares this way, as it demonstrates a willingness to engage with people and meet them where they are without compromising their professionalism or integrity.

Wesley Financial Group Commercials

Wesley Financial Group has run a handful of commercials – in addition to their video testimonials – to advertise their services. A few of these TV spots can be found on iSpot.tv, including one called “Timeshare Nightmare” and another called “The Ugly Truth.” These are short and simple but well-made, and feature clips from actual customer testimonials. You can review these commercials below:

There is another hub for Wesley’s commercials, which is an official website called icanceltimeshare.com. This website is another straightforward landing page, but one that includes a great deal of transparency and information for prospective customers. While the videos you can watch here are mostly testimonials, they are stories that, as noted above, give Wesley a great deal of credibility. That people are willing to go on camera and talk at length about how Wesley Financial Group helped them says a lot about their integrity and effectiveness.

Wesley Financial Group FAQs

Here are some answers to a few of the frequently asked questions we’ve seen around the Internet about Wesley Financial Group.

-

- How does Wesley Financial Group cancel timeshares? As noted above, Wesley cancels timeshares by directly contacting and putting pressure on resorts and developers. They do not use lawyers in order to release people from contracts. This “Advocate Model” has proven to be highly effective.

-

- Does the timeshare exit process have a negative effect on your credit rating?The answer to this question varies. It is possible in many situations for this to occur after a timeshare contract is canceled. However, when it comes to working with Wesley Financial Group, they take painstaking measures to make sure clients’ credit is not damaged by the timeshare exit process. In fact, they report that many people’s credit actually improves after their timeshares are canceled.

-

- Can you trust Wesley Financial Group? Yes. In spite of what the timeshare resorts and developers want people to think, their business model is trustworthy, legal, and effective.

Is Wesley Financial Group Legitimate?

So, with all of this in mind, is Wesley Financial Group legitimate? Absolutely. They have been and continue to be one of the strongest and most reliable timeshare cancellation companies in the industry. While this has led to trouble from the timeshare developers and resorts themselves, this does not undermine their integrity as a company. If you think your situation is one that they would investigate further, we would encourage you to have a look at their website and social media pages to get a better understanding of them as a business.

Summary

As you can probably conclude, Wesley Financial Group comes by their good reputation honestly. Their years in business and high Dun & Bradstreet rating bolster this. This is all part of why they are an exception to our usual advice of only recommending timeshare exit companies that use escrow for payment.

While escrow payment options are a guarantee that the timeshare exit company won’t get paid in full until you’ve been released from your contract, they do typically mean paying higher fees for the company’s services. So when it comes to working with Wesley Financial Group, you can expect to save some money while being able to trust their money-back guarantee. They have proven themselves to have the financial net worth to give your money back if they aren’t successful in canceling your timeshare.

Overall, we can absolutely recommend working with Wesley Financial Group when you need help not only getting out of your timeshare, but also doing so with a company that puts their clients’ needs first.

you can also call them directly at 1-800-711-7805.

If you still have questions about canceling your timeshare, feel free to get in touch with us. You can do so by submitting the contact form on the right side of the page, initiating the live chat, or calling us at 833-416-8796.

Wesley Financial Group Review Read More »